As organizations look ahead to 2026, executive hiring priorities are increasingly shaped by execution pressure rather than expansion ambition. Across Talentfoot’s core industries, leaders are being evaluated less on vision alone and more on their ability to manage cost structures, deliver predictable revenue, navigate regulatory complexity, and operate effectively in uncertain economic conditions.

This piece examines the executive roles most consistently identified as critical across industries as we look ahead to 2026, drawing exclusively on verifiable labor market data, executive surveys, and industry outlooks published between 2023 and 2025.

Data Sources

This analysis is grounded in a set of cross-industry, foundational data sources used to identify broad executive demand trends. Additional industry-specific and regulatory sources are cited directly within relevant sections of the article.

- U.S. Bureau of Labor Statistics (Occupational Outlook Handbook, OEWS)

- PwC’s Global CEO Survey (2025)

- Bain & Company, Global Private Equity Report (2025)

- World Economic Forum, Future of Jobs Report (2025)

- McKinsey & Company, Economic Conditions Outlook, Technology Trends Outlook, State of AI

- Deloitte’s 2025 Global Boardroom and C-Suite Survey on Organizational Resilience

- LinkedIn’s Economic Graph and Workforce Reports

- Gartner and Federal Reserve publications where relevant

Only roles explicitly referenced in published data as critical, expanding, or experiencing elevated turnover are included.

Cross-Industry Signals Shaping Executive Demand

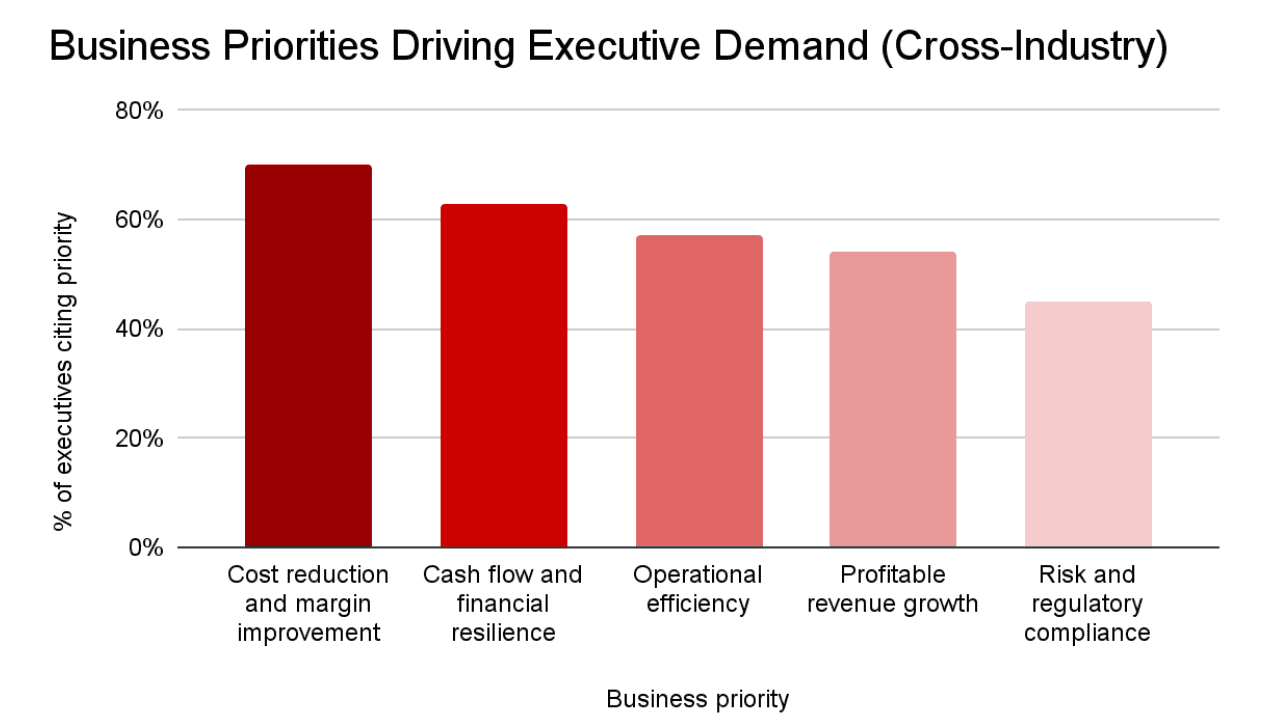

Across industries, the data indicates a clear shift in what boards and investors expect from executive leadership. Cost containment, capital efficiency, and operational resilience now rank ahead of aggressive expansion in many sectors. Deloitte’s 2025 Global Boardroom and C-Suite Survey on Organizational Resilience found that a majority of executives see rising strategic uncertainty as a top leadership challenge, with nearly 70% of surveyed board members and C-suite executives identifying organizational resilience as a critical priority for the year ahead. This underscores the need for leaders who can manage cost structures, risk exposure, and execution performance while still enabling growth.

Operational efficiency has also emerged as a dominant theme. McKinsey & Company’s Economic Conditions Outlook and Deloitte’s 2025 Global Boardroom and C-Suite Survey on Organizational Resilience research highlights execution gaps as a primary driver of underperformance, particularly in organizations that scaled rapidly earlier in the decade. As a result, demand for executives who can optimize operations, tighten forecasting, and improve accountability has increased across industries.

Sources: Deloitte Global Resilience Survey (2024); McKinsey Global Economic Conditions Snapshot (2024)

(Tables reflect synthesized analysis across multiple authoritative sources to identify recurring executive demand patterns, rather than results from a single underlying dataset.)

SaaS

SaaS companies enter 2026 with a markedly different leadership posture than they held just a few years ago. After a prolonged period of capital abundance, many software organizations are now prioritizing sustainable growth, predictable revenue, and disciplined spending. LinkedIn’s Economic Graph research shows continued demand for senior revenue and finance leaders as companies focus on retention, pricing optimization, and sales efficiency.

Product leadership also remains critical, though the emphasis has shifted. McKinsey research indicates that AI-enabled features are increasingly viewed as baseline expectations rather than differentiators, placing pressure on product executives to deliver tangible customer and revenue impact rather than experimentation alone.

Most Frequently Cited In-Demand Executive Roles (SaaS)

Sources: Synthesized from LinkedIn Workforce Report – October 2025; McKinsey & Company Economic Conditions Outlook (Sept 2025); Bain & Company Technology Insights.

Private Equity / Venture Capital

Leadership change remains one of the most frequently cited levers for value creation in PE and VC-backed companies. Bain’s Global Private Equity Report notes that operating conditions have made execution discipline more important than multiple expansion, increasing scrutiny on portfolio company leadership teams.

COO and CFO roles are especially prominent as sponsors push for faster operational improvements, tighter working capital management, and exit readiness. At the same time, talent instability during transformation has elevated the importance of human capital leadership, particularly in larger portfolio organizations.

Sources: Synthesized from Bain & Company, Global Private Equity Report (2025); Deloitte’s 2025 Global Boardroom and C-Suite Survey on Organizational Resilience; World Economic Forum, Future of Jobs Report.

Leadership Turnover in PE Portfolio Companies

Sources: Bain Global Private Equity Report; Deloitte Private Equity Outlook.

Management Consulting

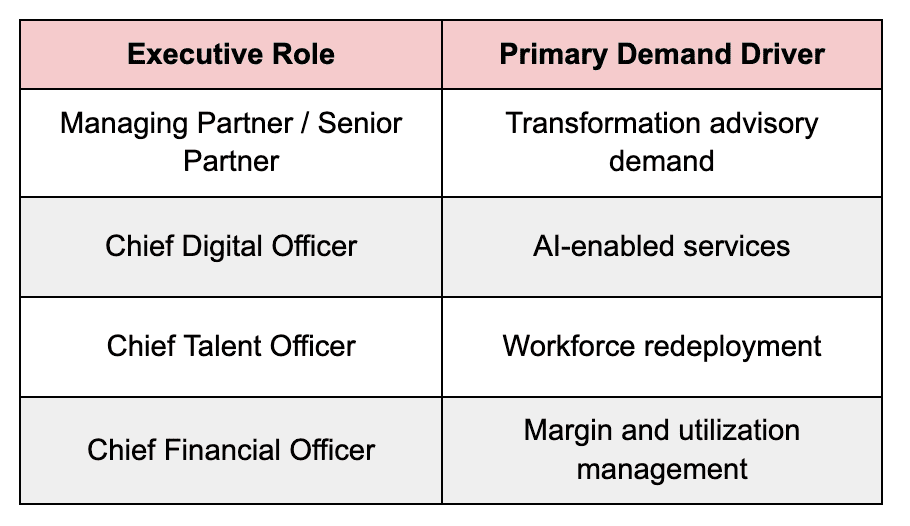

Management consulting firms face a dual challenge entering 2026: moderating discretionary client spending while expanding higher-value transformation and AI-enabled services. Deloitte and WEF research indicates that leadership strain is most pronounced in digital capability, talent management, and partnership models.

Senior partners remain in demand as firms reposition offerings, while digital and talent leaders are increasingly central to maintaining competitiveness and delivery capacity in a tighter labor market.

Most Frequently Cited In-Demand Executive Roles (Consulting)

Sources: Synthesized from World Economic Forum, Future of Jobs Report; Deloitte Human Capital Trends; McKinsey & Company Economic Conditions Outlook.

Martech / Adtech

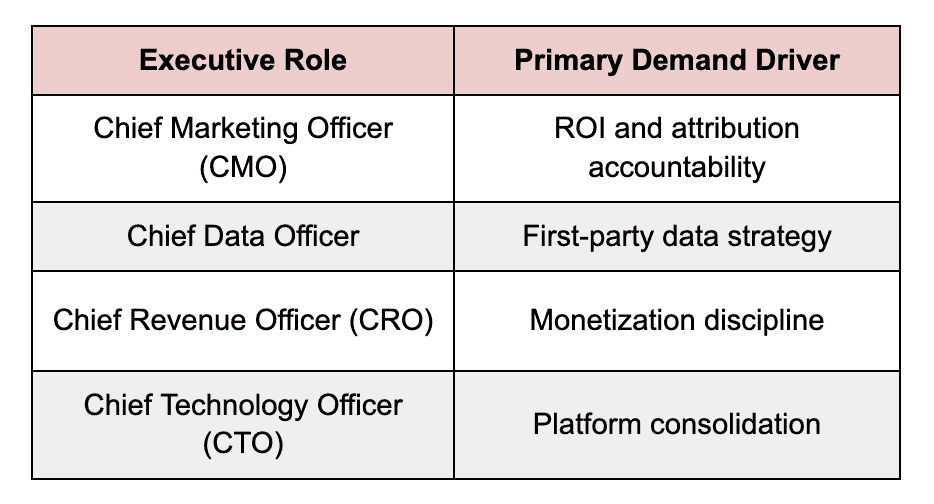

Martech and Adtech companies continue to operate under pressure from evolving privacy regulations and persistent attribution challenges. Gartner and Forrester research shows that executive accountability for data strategy has increased as third-party data reliance declines.

Revenue leadership remains important, but with greater emphasis on monetization discipline and customer lifetime value rather than top-line growth alone.

Most Frequently Cited In-Demand Executive Roles (Martech / Adtech)

Sources: Synthesized from Gartner CMO Survey; LinkedIn Workforce Report – October 2025; McKinsey digital/technology insights.

Marketing Services

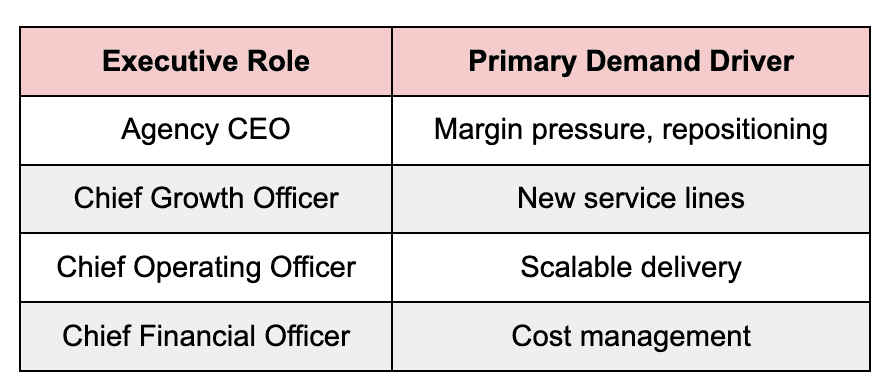

Marketing services firms face margin compression and evolving client expectations around performance accountability. Industry surveys indicate that leadership teams are being reshaped to support diversification into higher-margin services while maintaining efficient delivery models.

As a result, growth and operations leadership roles are increasingly emphasized alongside traditional agency leadership positions.

Most Frequently Cited In-Demand Executive Roles (Marketing Services)

Sources: Synthesized from Association of National Advertisers (ANA) Agency Report; Deloitte services/industry outlooks; HubSpot State of Marketing

Consumer Goods

Consumer goods companies continue to navigate supply chain volatility, cost inflation, and shifting consumer behavior. McKinsey research consistently identifies supply chain resilience as a top executive concern, reinforcing demand for specialized operational leadership.

Marketing and finance leaders also remain critical as companies balance brand investment with margin protection.

Most Frequently Cited In-Demand Executive Roles (Consumer Goods)

Sources: Synthesized from McKinsey Supply Chain Risk Pulse 2025; U.S. Bureau of Labor Statistics Occupational Outlook Handbook; Deloitte Consumer Products Industry Outlook.

Pharmaceutical

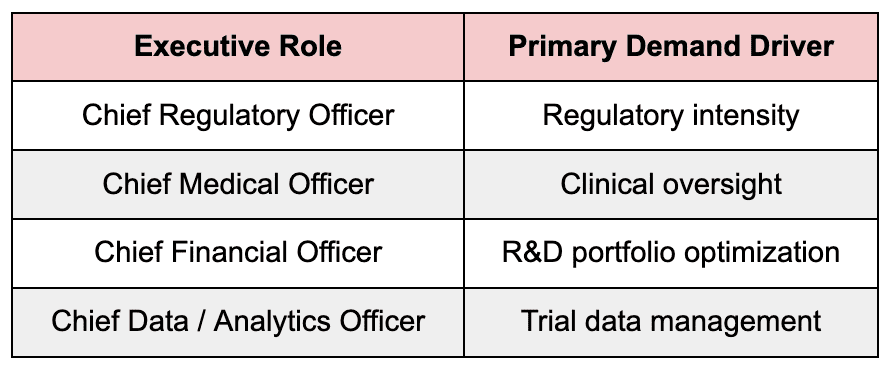

Pharmaceutical leadership demand reflects rising regulatory scrutiny and increasingly complex clinical pipelines. FDA and IQVIA publications highlight the expanding scope of regulatory and medical leadership roles as organizations manage global trials and compliance obligations.

Financial leadership remains important as companies balance R&D investment with cost discipline.

Most Frequently Cited In-Demand Executive Roles (Pharma)

Sources: Synthesized from FDA annual/regulatory reports; IQVIA Institute pharma outlook reports; McKinsey life sciences research.

Financial Services

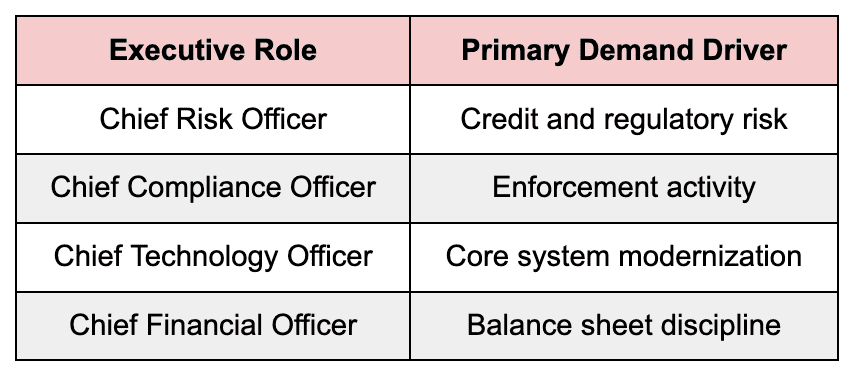

Financial institutions continue to operate under heightened regulatory scrutiny while modernizing core systems. Federal Reserve and Deloitte research consistently identifies risk and compliance leadership as expanding executive priorities.

Technology leadership is also critical as institutions balance digital transformation with stability and security requirements.

Most Frequently Cited In-Demand Executive Roles (Financial Services)

Sources: Synthesized from Federal Reserve reports; Deloitte Financial Services Outlook; U.S. Bureau of Labor Statistics occupational data.

Cross-Industry Role Frequency

Sources: Synthesized from all industry analyses presented in this report, informed by World Economic Forum Future of Jobs Report, U.S. Bureau of Labor Statistics, McKinsey & Company, Deloitte, and Bain & Company research.

The table highlights how finance and operations leadership roles cut across most industries, while revenue, marketing, and risk roles concentrate in sectors where growth models or regulatory exposure create more specialized leadership needs.

What This Means for 2026 Leadership Planning

Across Talentfoot’s industries, executive demand is increasingly shaped by execution, accountability, and resilience. Leaders who can manage financial complexity, operational efficiency, and regulatory risk are positioned to remain in high demand as organizations plan for 2026.

The consistency of these signals across labor market data, executive surveys, and industry outlooks suggests this shift is structural rather than temporary.

Please reach out to Talentfoot for support in making cross-industry leadership hires in 2026.