Incentive design is one of the most important, and most misunderstood, components of sales compensation. While Part 1 of Talentfoot’s 2026 Sales Compensation Study examined base pay, On-Target Earnings (OTE), quota, and performance outcomes, this second instalment takes a deeper look at the incentives that sit beneath those structures: bonuses, SPIFFs, contests, profit sharing, and the non-monetary benefits influencing motivation.

Talentfoot analyzed anonymized responses from sales professionals across the U.S. and Canada, including both experienced individual contributors and revenue leaders. The results show that while most companies still use traditional sales incentives, sellers now care most about three things: clear goals, real earning potential, and a fair chance for everyone to participate. These details matter, because the way incentives are set up has a direct impact on how quickly deals close, how often sellers hit their targets, and how engaged they stay- especially on teams that don’t work together in person every day.

All data in this article is sourced from Talentfoot’s 2026 Sales Compensation Study, conducted across the U.S. and Canada.

Who answered?

Respondents represent a nationally distributed, highly experienced sales population. Most have more than 10 years of experience, over two-thirds hold leadership roles, and the majority work in mid-market or enterprise environments. This gives the dataset a strong strategic lens: many respondents have experience both designing incentive plans and operating within them.

Their seniority also helps explain the nuanced feedback around contest structure, payout clarity, and upside potential. Veteran sellers tend to recognize quickly when an incentive plan misaligns with the company’s stated objectives, and they call it out here.

Attribute | Profile |

Geography | 30+ U.S. states & Canadian provinces |

Experience | Majority with 10+ years |

Role Level | Mix of leadership and experienced ICs |

Company Size | 50-1,000+ employees |

What do today’s sales compensation plans most commonly include?

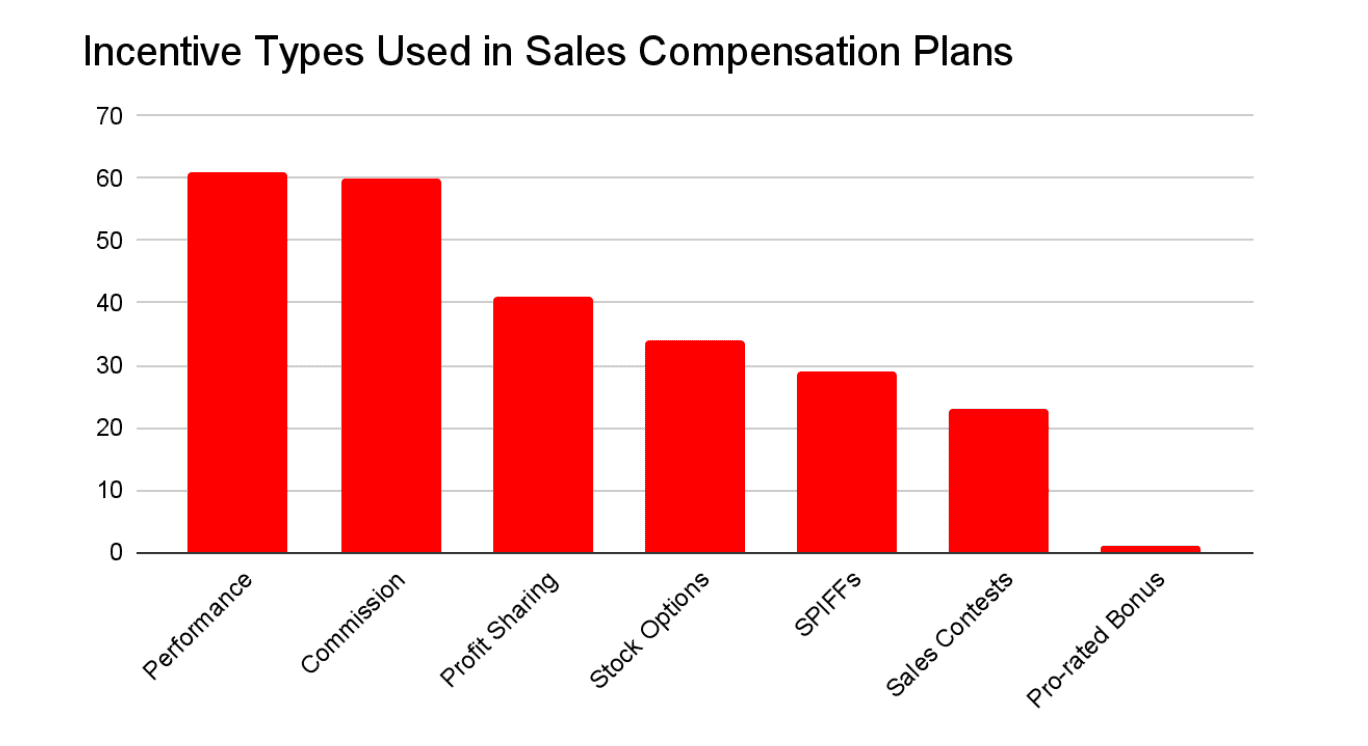

The data shows that sales teams still depend heavily on traditional incentive types, but the combination varies meaningfully by company size, funding model, and GTM motion. For example, profit sharing appears more commonly in professional services and manufacturing, while stock options cluster in SaaS and PE-backed environments. SPIFFs (sales performance incentive funds) and contests show the greatest variability; some companies use them weekly, others not at all.

Commission and performance bonuses appear most frequently, while SPIFFs, contests, profit sharing, and equity act as supplemental motivators. For many respondents, these additional levers serve as signals of organizational investment in sales success. Where they are absent, sellers report a perception that leadership is not fully committed to rewarding overperformance.

What behaviors do sales incentives actually drive?

When asked what behaviors or outcomes their incentives are intended to reinforce, respondents pointed to four themes central to modern GTM priorities. These outcomes reflect the broader shift toward revenue efficiency, where retention and expansion increasingly matter as much as acquisition.

Incentive Focus Area | Common Roles |

Net-new revenue | AEs, hunters, acquisition roles |

Expansion revenue | AMs, enterprise sellers |

Retention metrics | Renewal teams, leadership |

Pipeline creation & coverage | SDRs/BDRs, sales managers |

Importantly, many respondents indicated that their incentives touch multiple categories simultaneously. For example, leaders often have blended incentive plans that include both revenue and health-of-pipeline objectives. This multi-metric design is becoming increasingly common as companies aim to balance short-term performance with long-term customer value.

How effective are sales incentives and contests?

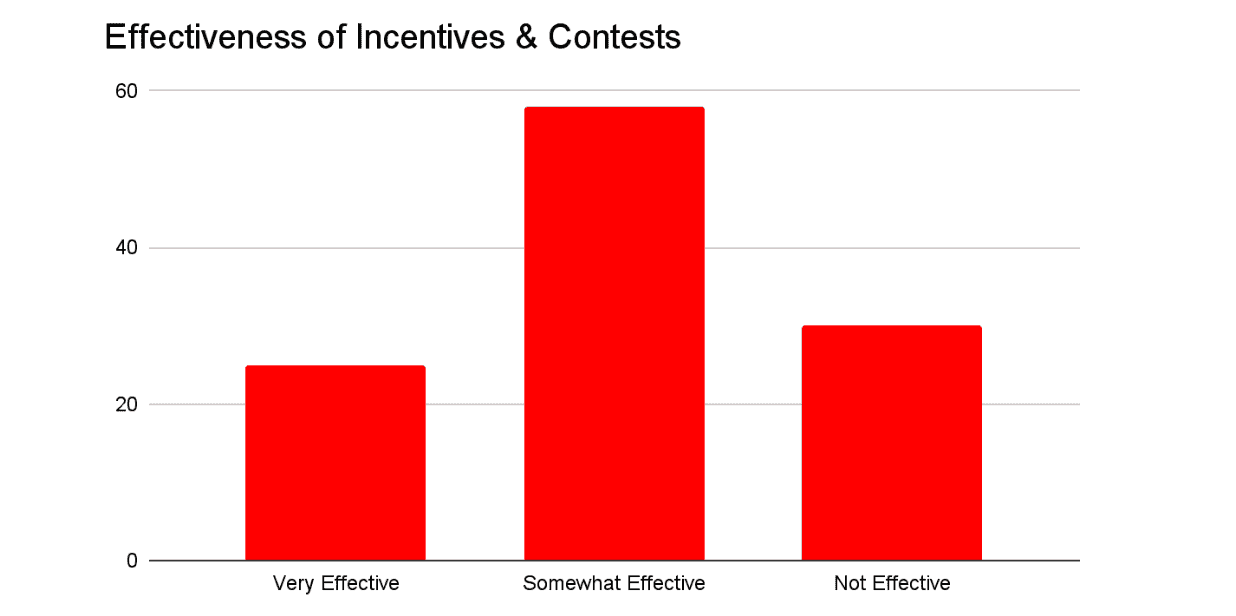

A majority of respondents describe their incentives as “somewhat effective,” signalling that plans are directionally sound but lack the optimization needed to unlock top-tier performance. Sellers frequently noted issues like unclear accelerator thresholds, unpredictable payout timing, and contests that feel disconnected from daily activities.

Interestingly, the “not effective” group often overlaps with respondents who rated their compensation plans as overly complex in Part 1. Simplicity appears to be a key driver of perceived fairness and motivation. Conversely, the “very effective” cohort typically referenced clear accelerators, well-communicated SPIFFs, and predictable payout cycles.

What would sellers do to improve sales contests in 2026?

Respondents offered precise, actionable insights on how to make contests more motivating. Their feedback suggests that the highest-performing contests share three characteristics: simplicity, visibility, and meaningful upside. When contests check these boxes, even sellers who are not typically contest-driven report higher engagement.

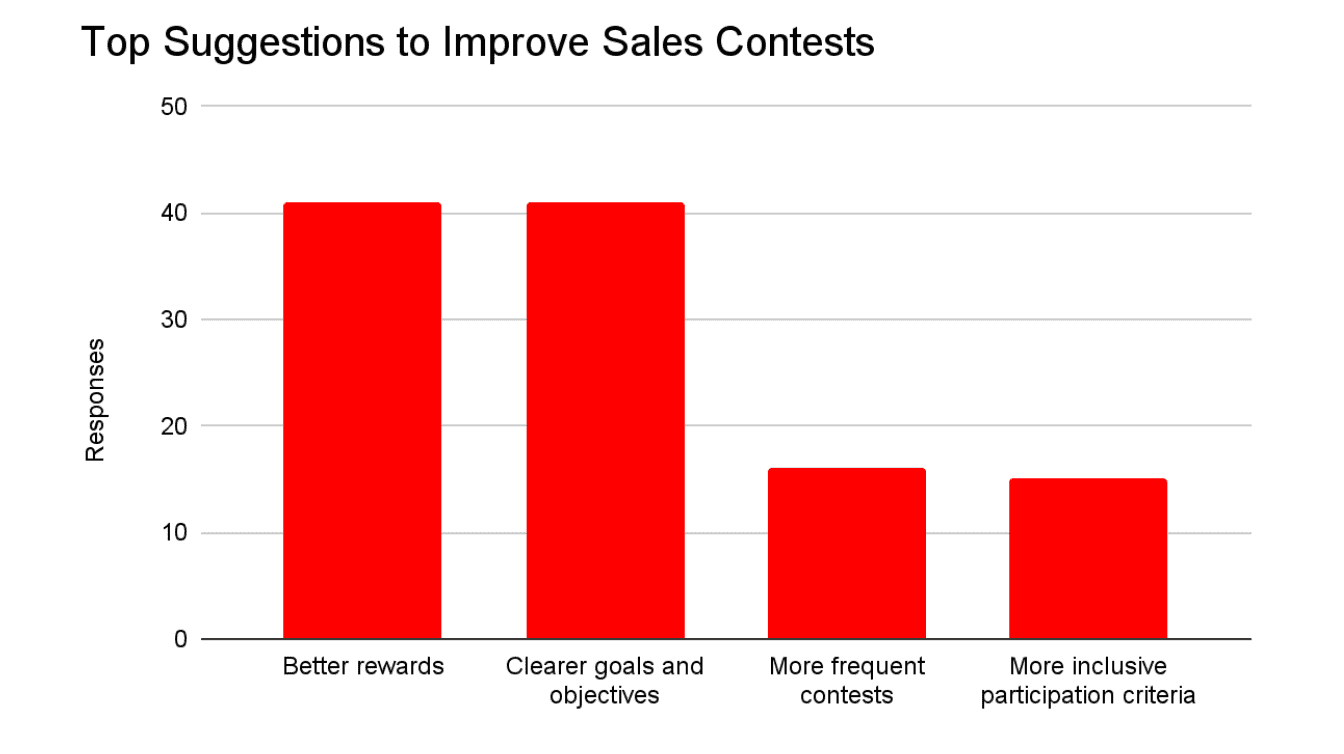

Top Suggestions to Improve Sales Contests

While the chart illustrates the overall distribution of responses, the qualitative feedback behind these selections adds important context. Many sellers emphasized that the effectiveness of any contest depends not just on the reward itself, but on how attainable, transparent, and aligned the rules are with day-to-day selling motions. To highlight these underlying themes, the table below breaks down each improvement area and the specific performance barriers it helps resolve.

What Are Additional Seller-Requested Improvements to Sales Contensts?

Incentive Focus Area | % of Respondents | What it Solves |

Better Rewards | 36% | Boosts perceived value of participation |

Clearer goals & objectives | 36% | Reduces confusion and builds trust |

More Frequent Contests | 15% | Maintains year-round engagement |

More Inclusive participation | 13% | Ensures broader team motivation |

Several respondents also noted that contests tied to specific, strategic behaviors (e.g., multi-threading, outbound velocity, early-quarter pipeline creation) tend to outperform “vanity” competitions that reward only raw volume. This offers a compelling opportunity for revenue leaders to align contest mechanics with evolving strategic priorities.

What is the role of non-monetary incentives in sales compensation?

Non-monetary incentives emerged as a powerful multiplier of job satisfaction and retention. While these benefits are not replacements for competitive pay, they meaningfully enhance the perceived fairness and attractiveness of the overall package. In competitive hiring markets, especially in major metros or high-growth hubs, these differentiators can tilt candidate decisions.

What are The Most Valued Non-Monetary Incentives for Sales leaders?

Incentive Types | Notes |

Flexible working hours & reduced travel | Most universally valued |

Professional development | Major retention driver |

Strong sales leadership | Consistently tied to satisfaction |

Recognition & awards | Best when paired with financial incentives |

Notably, several respondents described recognition programs, when thoughtfully executed, as “cultural accelerators” that reinforce high-performance environments without adding cost. This suggests that organizations with limited budget flexibility can still enhance motivation with intentional recognition frameworks.

How does incentive design impact seller motivation?

Respondents also highlighted the ways incentive design can unintentionally discourage performance. Complex payout formulas, shifting targets, or unclear eligibility rules repeatedly appeared as sources of friction. Sellers want to know exactly what is expected and what they stand to earn.

What are the Most Common Pain Points in Sales Incentive Plans?

Pain Point Category | What it Solves |

Insufficient incentives | “Upside is low; lack of good accelerators.” |

Base salary concerns | Sellers frequently noted that their floor is too low for the market. |

Transparency & fairness | Concerns around transparency and payout clarity appeared frequently across responses. |

Non-monetary incentives | Many respondents requested more professional development and greater flexibility. |

Payout mechanics | Issues like payout delays and chargebacks appeared frequently in feedback, often tied to reduced confidence in the plan. |

The throughline is clear: sellers thrive when incentive plans balance ambition with fairness. Even high-performing teams require predictable structures that reinforce trust and provide visibility into earnings potential.

How can employers more effectively design sales incentives and contests in 2026?

Three strategic insights emerge from the expanded the incentive data:

- Clarity is the most undervalued motivational tool.

Plans that provide real-time visibility into earnings and contest progress outperform even higher-paying but more complex structures. - Upside needs to feel attainable, not theoretical.

Sellers are quick to disengage from contests or accelerators perceived as unwinnable or disconnected from their territory realities. - Non-monetary benefits act as force multipliers.

Flexibility, development, recognition, and leadership quality increase engagement, reduce attrition, and enhance the perceived value of monetary rewards.

Taken together, the findings indicate that sellers respond best to holistic incentive ecosystems- not isolated mechanics. Employers who simplify their structures, increase transparency, and provide inclusive paths to upside will be better positioned to attract and retain top performers throughout 2026. To access Talentfoot’s complete sales compensation data, please click here.